Tax Power of Attorney Wisconsin Form – Adobe PDF

License / Price: Free

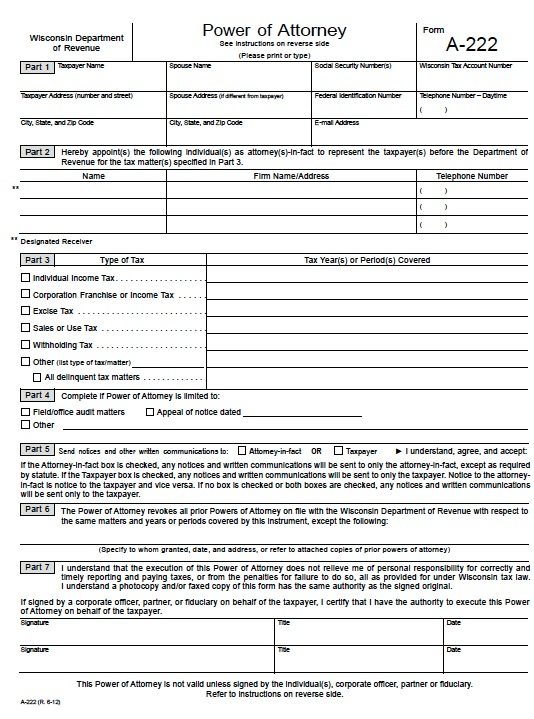

Version: Fillable Adobe PDF (.pdf)

File size: 104 Kb

8,407 Downloads

Otherwise known as form A-222, the tax power of attorney document allows a resident to choose anyone whom they deem fit to handle their tax filing with the Department of Revenue. Typically a Certified Public Accountant (CPA) or Tax Attorney is recommended. The document needs to be completed and signed by the principal with no witnesses or notary public acknowledgment needed.