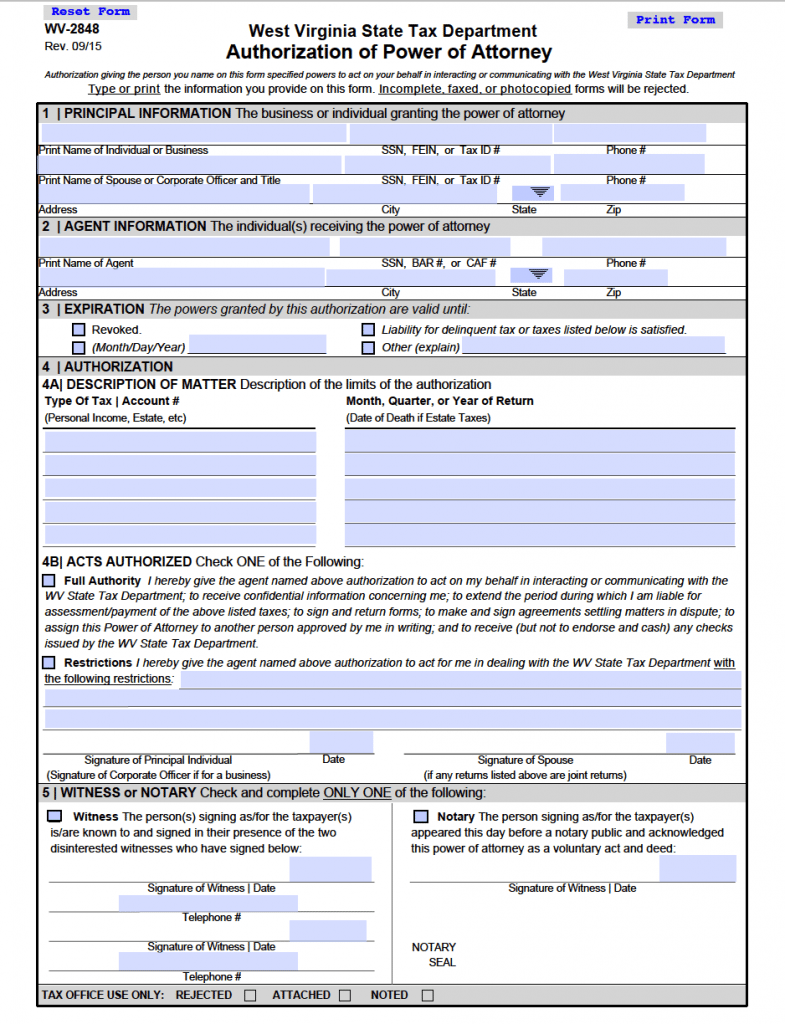

Tax Power of Attorney West Virginia Form – Adobe PDF

Also known as WV-2848, the West Virginia State Tax Department Authorization of Power of Attorney allows a resident to grant the following filing powers to an individual (highly recommended to be a tax attorney or certified public accountant (CPS));

- To receive (but not to endorse or cash) any checks issued by the West Virginia State Tax Department

- To receive confidential tax information concerning me

- To extend the period during which I am liable for assessment or payment of any state tax

- To sign tax returns and forms

- To make and sign agreements settling matters in dispute between the West Virginia State Tax Department

- To assign this power of attorney to another person approved by me in writing

The form will become in effect after completing and authorizing in front of a notary public or two (2) adult witnesses. Send to the Tax Department at:

West Virginia State Tax Department

Revenue Division

Post Office Box 2389

Charleston, West Virginia 25328-2389

(3 votes, average: 4.00 out of 5)

(3 votes, average: 4.00 out of 5)