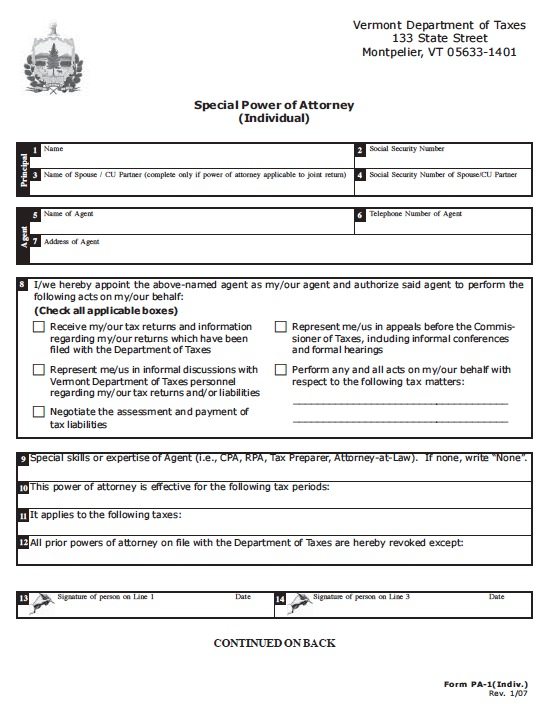

Tax Power of Attorney Vermont Form – PA-1 – Adobe PDF

License / Price: Free

Version: Fillable Adobe PDF (.pdf)

File size: 56 Kb

13,547 Downloads

Also known as Form PA-1, the tax power of attorney document allows for a resident to choose a professional, usually a Certified Public Accountant (CPA) or Tax Attorney, to handle the filing of State taxes with the Vermont Department of Taxes.

The principal may choose the agent to do all of the following;

- Negotiate the assessment and payment of tax liabilities

- Represent me/us in informal discussions with Vermont Department of Taxes personnel regarding my/our tax returns and/or liabilities

- Receive my/our tax returns and information regarding my/our returns which have been filed with the Department of Taxes

- Receive my/our tax returns and information regarding my/our returns which have been filed with the Department of Taxes

As with all power of attorney documents in Vermont, the tax version should be signed with at least (2) witnesses or a notary public.