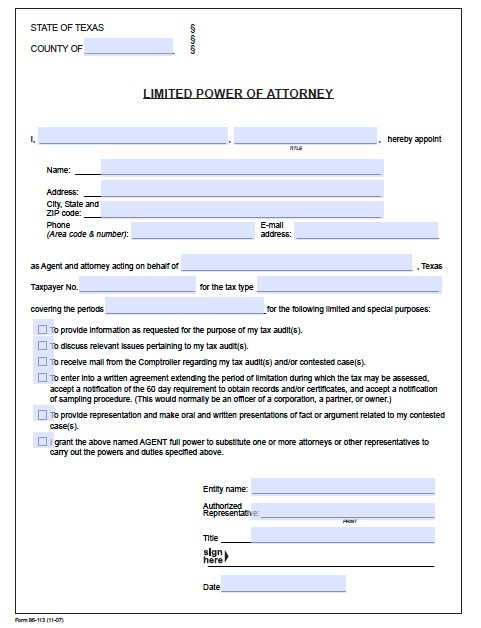

Tax Power of Attorney Texas Form – Adobe PDF

Also known as form 86-113, the tax power of attorney form for the State of Texas is used to allow another person to handle your tax filing in addition;

- To provide information as requested for the purpose of my tax audit(s).

- To discuss relevant issues pertaining to my tax audit(s).

- To receive mail from the Comptroller regarding my tax audit(s) and/or contested case(s).

- To enter into a written agreement extending the period of limitation during which the tax may be assessed, accept a notification of the 60 day requirement to obtain records and/or certificates, and accept a notification of sampling procedure. (This would normally be an officer of a corporation, a partner, or owner.)

- To provide representation and make oral and written presentations of fact or argument related to my contested case(s).

There is no need for a witness to authorize or a notary public. A simple signature by the principal and the document is acceptable by the Texas Comptroller.

(6 votes, average: 3.67 out of 5)

(6 votes, average: 3.67 out of 5)