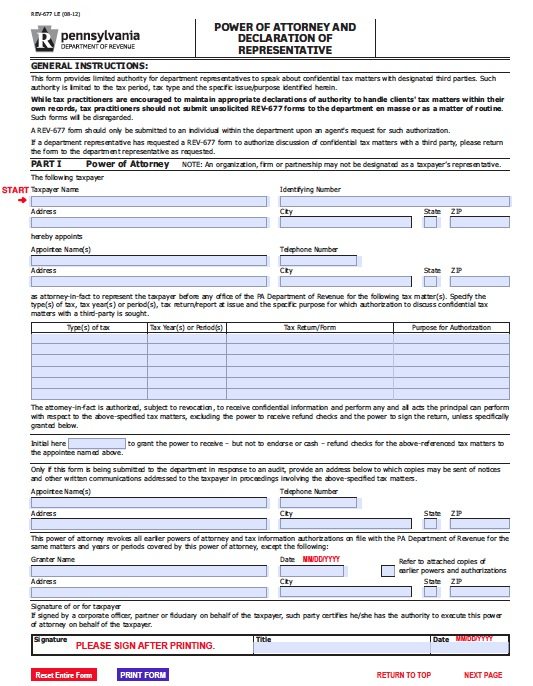

Tax Power of Attorney Pennsylvania Form – Adobe PDF

License / Price: Free

Version: Fillable Adobe PDF (.pdf)

File size: 246 Kb

12,692 Downloads

Form is provided by the Pennsylvania Department of Revenue to allow a person to be able to select a tax professional to step in and file on their behalf. The person filing should be aware that any errors or mistakes made by the preparer is ultimately their liability. Therefore, the principal should take caution as to the person whom they choose and make sure the individual has prior experience with the tax laws of Pennsylvania.

- There is no notary public acknowledgment or witnesses needed when authorizing. The principal just needs to sign their name.

(5 votes, average: 3.60 out of 5)

(5 votes, average: 3.60 out of 5)