Durable Power of Attorney Pennsylvania Form – PDF & Word

Under a Pennsylvania financial power of attorney, you name a person who will have a fiduciary duty to you as your agent to handle any type of all your monetary related affairs on your behalf. You should also name an alternate in case your first choice can’t serve when needed, and both should reside close-by to handle things in person when needed.

Your choice should be someone who you trust, and the he or she should be capable of handling everything from paying everyday bills to managing your business investments and assets. All power of attorney documents terminate when you die, and in Pennsylvania, it also ends upon divorce if you choose your spouse as your agent. You can revoke this form at any time you are mentally competent to do so by completing a revocation form.

Under this document the agent selected may carry out the following transactions;

• To make limited gifts.

• To create a trust for my benefit.

• To make additions to an existing trust for my benefit.

• To claim an elective share of the estate of my deceased spouse.

• To disclaim any interest in property.

• To renounce fiduciary positions.

• To withdraw and receive the income or corpus of a trust.

• To authorize my admission to a medical, nursing, residential, or similar facility and to enter into agreements for my care.

• To authorize medical and surgical procedures.

• To engage in real property transactions.

• To engage in tangible personal property transactions.

• To engage in stock, bond, and other securities transactions.

• To engage in commodity and option transactions.

• To borrow money.

• To enter safe deposit boxes.

• To engage in insurance transactions.

• To engage in retirement plan transactions.

• To handle interests in estates and trusts.

• To pursue claims and litigation.

• To receive government benefits.

• To pursue tax matters.

• To make an anatomical gift of all or part of my body.

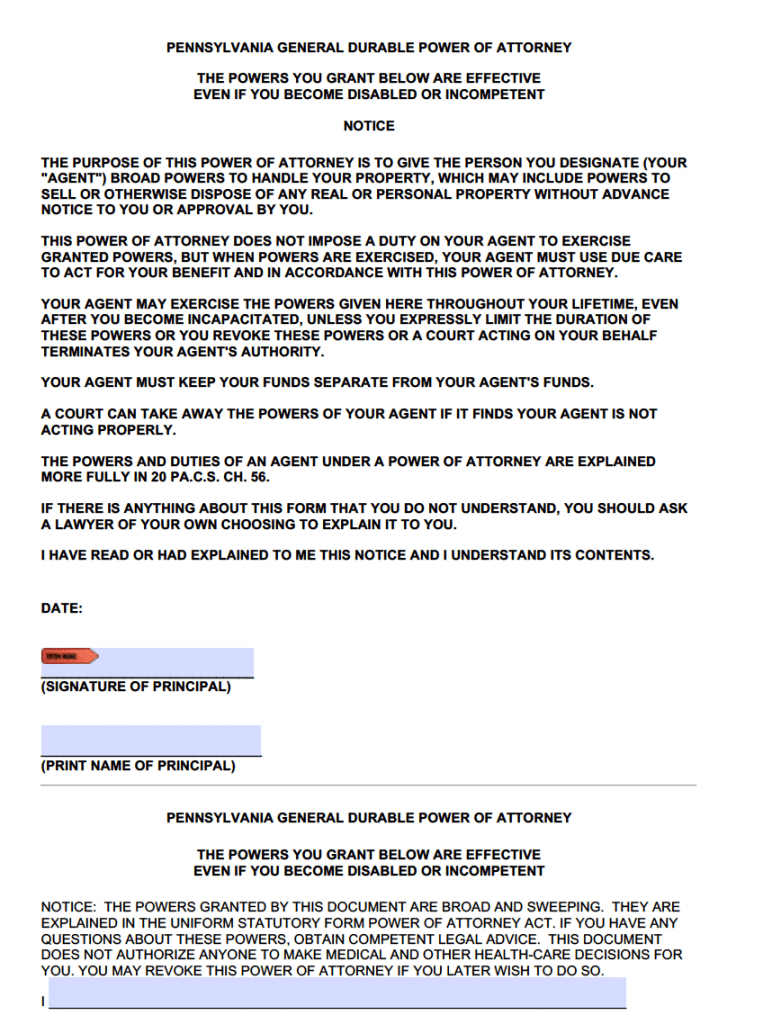

It is required that this form be signed in the presence of a notary public or at least two (2) adult witnesses in order for it to take effect.

(448 votes, average: 3.38 out of 5)

(448 votes, average: 3.38 out of 5)