Durable Power of Attorney North Carolina Form – Adobe PDF

Through a North Carolina Financial Power of Attorney, you appoint an Attorney-In-Fact to make all your monetary related decisions for you immediately, or structure the document so it only becomes in effect when you can no longer speak for yourself. Your choice in the agent should meet your full confidence and trust in both their integrity and in their business sense as they will have unlimited access and power in this regard. It is wise to appoint someone who will be available locally to effect tighter control, and choosing an alternate in case your first choice turns out to be unavailable.

The usual choices include close friends, relatives and your spouse, and if you choose the latter to note that in this State, the agreement doesn’t necessarily become void upon divorce. You yourself can terminate the agreement at any time that you are mentally competent to do o by authorizing the revocation form. If you want your Attorney-In-Fact to take over immediately, you should opt for a “Durable” Financial Power of Attorney, or it becomes void if and when you do become incapacitated. The more usual route is for a “Springing” Durable Power of Attorney, which only goes into effect at that point.

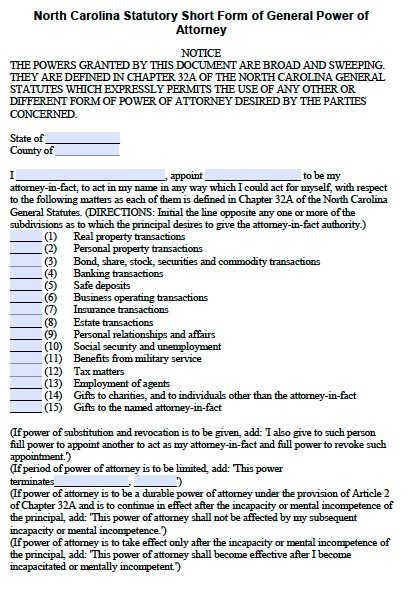

- Text Version from the State – Chapter 32A Article 1

The powers you may grant your agent under this agreement are as follows;

- Real property transactions

- Personal property transactions

- Bond, share, stock, securities and commodity transactions

- Banking transactions

- Safe deposits

- Business operating transactions

- Insurance transactions

- Estate transactions

- Personal relationships and affairs

- Social security and unemployment

- Benefits from military service

- Tax matters

- Employment of agents

- Gifts to charities, and to individuals other than the attorney-in-fact

- Gifts to the named attorney-in-fact

(470 votes, average: 3.36 out of 5)

(470 votes, average: 3.36 out of 5)