Tax Power of Attorney Montana Form – Adobe PDF

License / Price: Free

Version: Adobe PDF (.pdf) Template

File size: 76 Kb

5,254 Downloads

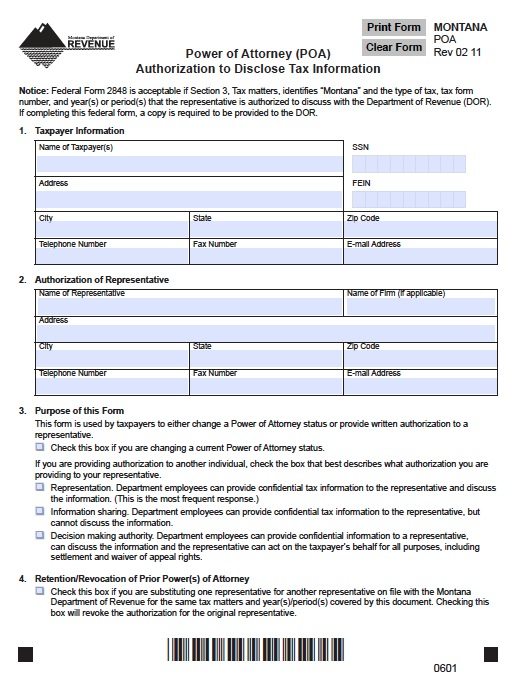

Allows the authorization of your agent to handle and disclose your tax filings. This is a must have form if you plan to have another person hold responsibility for your tax decisions in the State of Montana. Unlike other power of attorney documents in Montana, this form does not need to be notarized or your signature be witnessed.

- Notice: Federal Form 2848 is acceptable if Section 3, Tax matters, identifi es “Montana” and the type of tax, tax form number, and year(s) or period(s) that the representative is authorized to discuss with the Department of Revenue (DOR). If completing this federal form, a copy is required to be provided to the DOR.

- You may send the form to the Department of Revenue one of the following ways;

- Fax – 1(406) 444-4375

- Mailing Address

Montana Department of Revenue

Legal Services, Disclosure Office

125 N. Roberts

PO Box 7701

Helena, MT 59604-7701