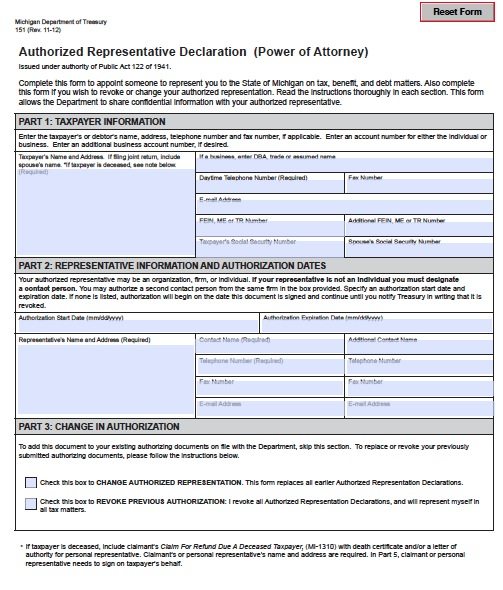

Tax Power of Attorney Michigan Form – Adobe PDF

The Michigan tax power of attorney, or ‘Form 151‘, allows for a representative to handle any and all tax filings with the Department of Treasury in regards to individuals and businesses. The principal, or person being represented, may choose to allow someone else to handle any of the following;

1. Receive, inspect and provide confidential information

2. Represent me and make oral or written presentation, of fact or argument

3. Sign returns

4. Enter into agreements

Unlike other power of attorney documents in Michigan, this form does not need to be witnessed or notarized. When complete (if an individual) send to:

- Mailing Address Michigan Department of Treasury

Customer Contact Center, Individual Correspondence Section

P.O. Box 30058

Lansing, MI 48909 - Fax – 1(517) 636-4488

(2 votes, average: 4.00 out of 5)

(2 votes, average: 4.00 out of 5)