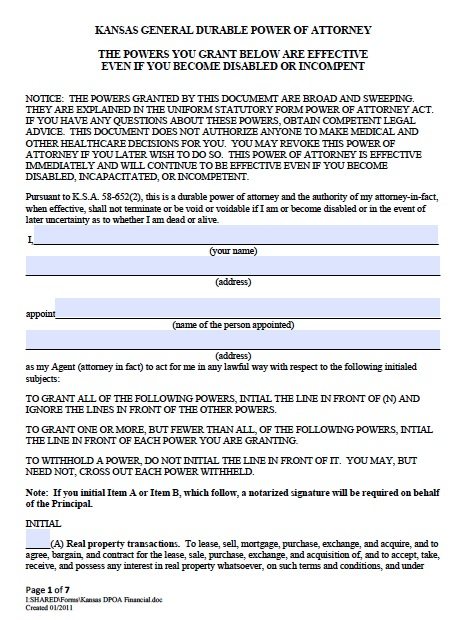

Durable Power of Attorney Kansas Form – Adobe PDF

When creating a financial power of attorney form in Kansas, it is important to note the person you choose to be your Attorney-In-Fact does not need to be a lawyer. Most individuals choose their spouse or a close relative. Integrity is paramount in the choice. It would also be helpful if the individual were available locally to deal with your business matters in a hands-on manner. He or she should be capable of understanding the intricacies of your business affairs, as complex or as simple as they may be. It is also prudent to name a second (2nd) Attorney-In-Fact, in case your first choice cannot serve when he or she is needed.

If your plan calls for your Attorney-In-Fact to take over immediately, your Financial Power of Attorney must be specified as being “durable” such as this form, or it becomes void on the event of your physician certifying that you are incapacitated (See the General Form for an arrangement that terminates upon disability). A “springing” Durable Financial Power of Attorney, on the other hand, only goes to into effect on the event of your incapacitation.

If you do choose your spouse as your Attorney-In-Fact and you subsequently divorce, in Kansas the form automatically ceases. As long as you are mentally competent, you can end the agreement at any time you choose by authorizing a revocation form.

- Durable Power of Attorney Laws

- Statute 58-652: Effectiveness of power of attorney; recording; revocation; attorney in fact.

(56 votes, average: 3.57 out of 5)

(56 votes, average: 3.57 out of 5)