Tax (LGL-001) Power of Attorney Connecticut Form – PDF

License / Price: Free

Version: Fillable Adobe PDF (.pdf)

File size: 86 Kb

Use this Form To: Choose (typically a CPA) someone to handle your tax filing within the State of Connecticut.

8,601 Downloads

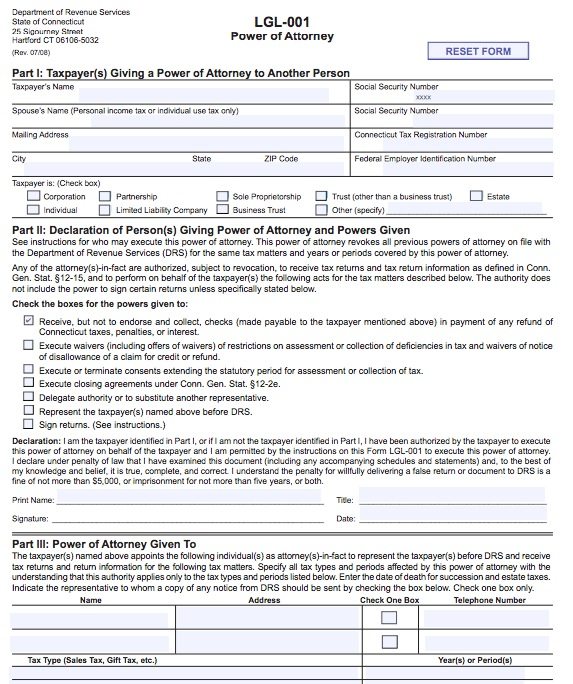

The tax power of attorney form for Connecticut, also known as the LGL-001, Lets you choose a person, typically a CPA or attorney with tax experience, to handle your tax filing within the State of Connecticut.

The form allows the principal to delegate the necessary tax powers to an agent;

- Receive, but not to endorse and collect, checks (made payable to the taxpayer mentioned above) in payment of any refund of Connecticut taxes, penalties, or interest.

- Execute waivers (including offers of waivers) of restrictions on assessment or collection of defi ciencies in tax and waivers of notice of disallowance of a claim for credit or refund.

- Execute or terminate consents extending the statutory period for assessment or collection of tax.

- Execute closing agreements under Conn. Gen. Stat. §12-2e.

- Delegate authority or to substitute another representative.

- Represent the taxpayer(s) named above before DRS.

- Sign returns. (See instructions on 2nd page.)