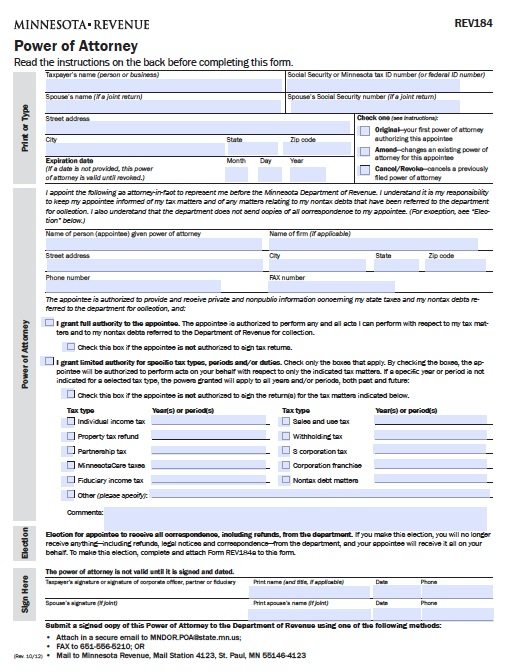

Tax Power of Attorney Minnesota Form – REV184 – Adobe PDF

The Minnesota tax power of attorney, known as the ‘Form Rev184’, allows for an accountant (CPA) or tax attorney to handle filings with the Department of Revenue in relation to;

- Individual income tax Sales and use tax

- Property tax refund Withholding tax

- Partnership tax S corporation tax

- MinnesotaCare taxes Corporation franchise

- Fiduciary income tax Non-tax debt matters

Unlike other power of attorney forms in Minnesota this document only requires the signature of the principal to be valid.

Submit a copy to the Department of Revenue by;

- E-Mail – [email protected]

- Fax – 1(651) 556-5210

- Mail – Minnesota Revenue, Mail Station 4123, St. Paul, MN 55146-4123

(3 votes, average: 3.33 out of 5)

(3 votes, average: 3.33 out of 5)