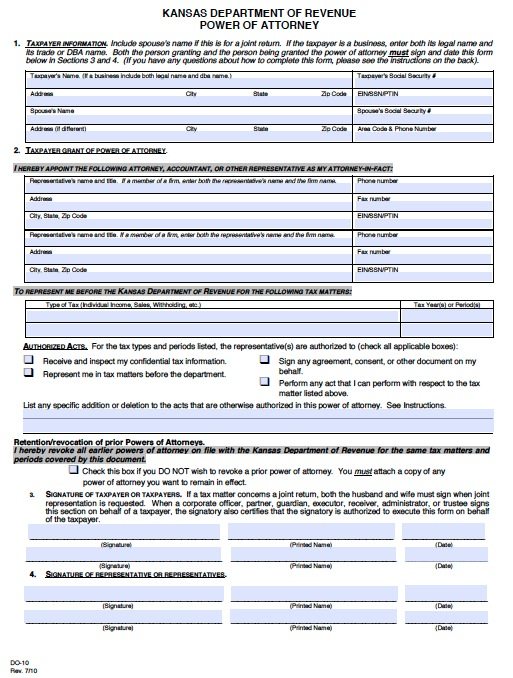

Tax Power of Attorney Kansas Form – DO 10 – Adobe PDF

License / Price: Free

Version: Adobe PDF (.pdf) Fillable

File size: 138 Kb

8,043 Downloads

Use to allow someone else to file your tax return with the Department of Revenue in Kansas. The agent selected may handle any or all of the following;

- Receive and inspect my confidential tax information.

- Sign any agreement, consent, or other document on my behalf.

- Represent me in tax matters before the department.

The principal may also list other powers that the agent is able to conduct on their behalf. Unlike the other power of attorney documents, this does not need to be witnessed or authorized in front of a notary public in order to be legal for use.